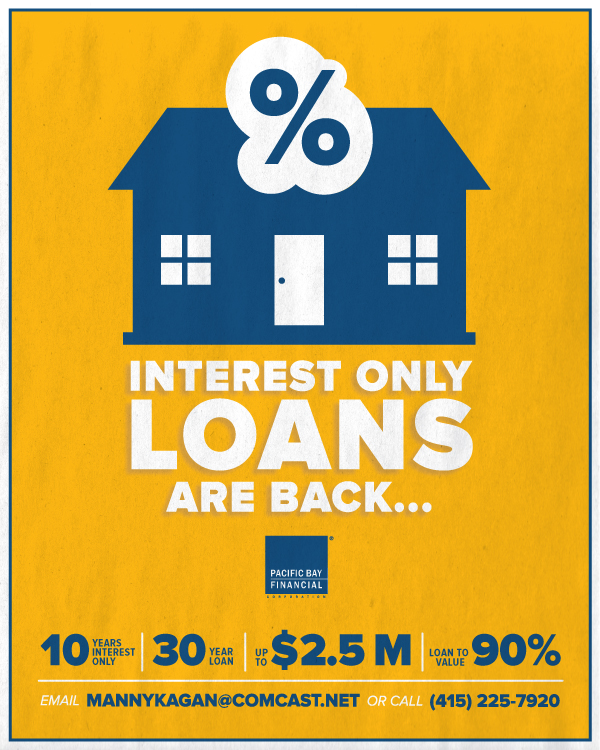

Flexible Mortgage Solutions™

I’ve recently received a phone call from one of my former clients. I spoke with her over a year ago. She needed money, but I could not help her then because of her credit cards’ debts was too high. We agreed that she would call me back after paying them off with her next commission income. This time, she wanted to refinance her private money second mortgage which she used to pay off credit cards and had an interest rate of 14%. After running her numbers, the result was that I could get her a second mortgage with the rate 9.9% and enough money to pay off her second loan, plus get the extra amount she requested.

However, when I told her that this is going to be a Reverse Mortgage Second, she became very upset. “I am not interested in a Reverse Mortgage. I do not want for the bank to take my home away.” Despite my explanation that this is not true and that banks do not take properties away unless taxes and insurance are not paid and that she has a choice to make monthly payments, she said that she did not want anything to do with the reverse mortgage.

This was not the first time I heard comments about losing one’s house to the bank. I have no idea from where these rumors came from; nevertheless, I decided to come up with a new name. There is a Chinese and Jewish tradition that changing the name changes luck. The new name I came up with is “Flexible Mortgage Solutions™” or FMS.

To benefit from FMS, the homeowner needs to be at least 55 and to have limited income. Property can be inherited, or be part of the divorce.

Flexible mortgages offer many optional solutions. The most important is that the borrowers have the options to choose whether to make full or partial mortgage payments, or not to make any payments until they sell their property or die. In that case, the heirs will have either to keep the property or sell it, paying off accumulated mortgage balance, which is similar to a conventional mortgage.

Tomorrow, I am going to start posting a series of short videos on my YouTube Channel answering your questions about FMS/Reverse Mortgages. You will be receiving alerts from me in your email.

Hope, this will help you and your friends.

Please click on this link to watch my brief announcement.

Stay tuned and share with a friend!

Manny Kagan,

President,

Pacific Bay Financial Corporation

(415) 225-7920; || mannykagan@comcast.net

NMLS #205637

DRE #00824602