Ask, Seek, Knock — And Know What to Ask

In the Bible, one of the most well-known teachings of Jesus is: “Ask, and it will be given to you; seek, and you will find; knock, and the door will be opened to you” (Matthew 7:7).

This powerful message speaks to the importance of intention and initiative in shaping our lives. Yet, a well-known joke provides a humorous twist on this teaching: a man prays fervently to God to win the lottery. After many desperate pleas, a voice finally calls down from Heaven, “Buy a lottery ticket.” The point is clear—desire alone is not enough. Action must follow.

Interestingly, despite dreams of wealth, many lottery winners eventually find themselves in bankruptcy. This raises a pressing question: what goes wrong? The answer may be simpler than we think. Many people simply do not know how to manage money, nor do they know the right questions to ask. It’s human nature to complain, to ask for more, to turn to a higher power for solutions—but without clarity, even the most generous answers can be lost.

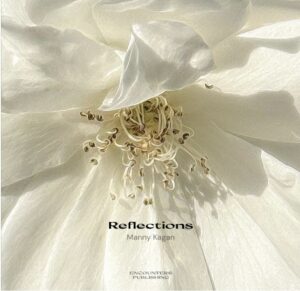

After publishing my book Reflections: The Healing Images™, I received feedback from a reader who experienced its intended effect—a calming, meditative state:

“Reflections” is more than just a book—it’s a sanctuary within pages. As a devoted reader and a clinical psychologist, I found an almost meditative escape in its words. No matter where I opened the book, closed my eyes, and counted to ten, the prose never failed to wrap me in a deep sense of relaxation and tranquility.

It’s as if the author understood the very essence of peace and distilled it into every passage. This is a book I will wholeheartedly recommend to others—not just for its wisdom, but for the calm it brings to the soul.”

The book was designed as a visual tool to help people quickly access deeper mental clarity and reduce anxiety, stress, or even physical discomfort like headaches. But there’s another layer to this process. What if, before entering meditation, you asked the universe the right question? Something as simple as “Why do I worry?” can open the door to surprising insight. When you ask the right question, you may discover that the worry dissipates—perhaps because it was never necessary in the first place.

“Ask, and it will be given to you.” But first—you have to buy the book.

Pictured here are three beautiful roses featured in “Reflections“. Someone once asked how I created the 3D effect in these images. The secret lies in the interplay of light and shadow—a gentle reminder that depth and beauty often emerge from contrast.

Care and share!