*The interest rate is fixed for 30 years for 4 units. Interest rates are subject to change without notice and do not constitute a commitment to make any loan at any specific rate.

Iris is a widow. She owns a condominium and works as an engineer. Her cousin, Nora, is divorced with a child and works as a nurse. As a result of the divorce, she not only lost her husband, but also a house which sold through a short sale.

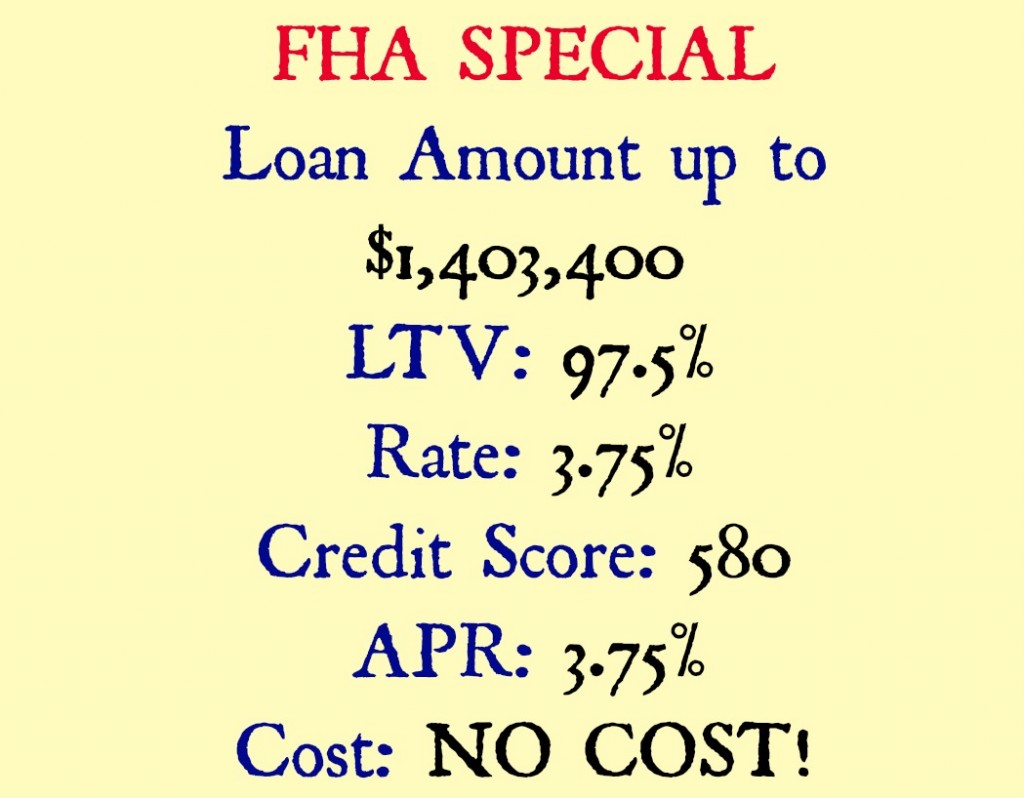

Both of them have good income and together they decided to buy a two-unit building. Though the amount of money both of them have is enough to secure a loan with 85% LTV (loan to value), Nora’s credit restricts their options.

The solution is an FHA loan, which allows borrowers who had a short sale to get new financing three years later.

First, Iris decided to refinance her condo, which she was going to rent to lower her mortgage payments by $300/month. Meanwhile, Nora simultaneously started the credit correction process.

Increasing Nora’s credit score to 740 would allow them to get a better loan AND to avoid paying mortgage insurance on an FHA loan.

Whom do you know who might benefit from creative mortgage solutions?

Do not keep me as a secret.

SMILE AND PLEASE SHARE IT WITH A FRIEND