JUMBO MORTGAGES EXPLAINED

Mortgages generally fall into two main categories: conforming and jumbo.

Conforming loan limits are set each year by the Federal Housing Finance Agency (FHFA). These limits apply to loans that can be purchased by Fannie Mae and Freddie Mac, and they vary based on both geography and the number of units in the property.

In addition to standard conforming loans, there are agency high-balance loans, which apply in higher-cost areas such as the San Francisco Bay Area.

For 2025, the current loan limits for single-family homes or condominiums in our area are:

- Conforming:$806,000

- Agency High Balance:$1,209,750

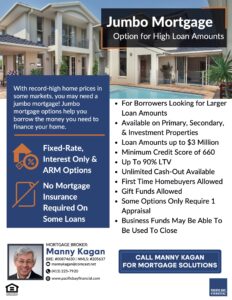

Any loan amount above $1,209,750 is considered jumbo. Loans over $3 million are referred to as super-jumbo. Each category has its own underwriting guidelines, and jumbo loans often require alternative ways to calculate income.

Why am I bringing this up? Because just last week, during our staff meeting, Fiona Khan from Wall Street Mortgage (WSM) shared their new jumbo fixed-rate programs. Then, almost immediately, a former client called me about purchasing a $2 million home with 20% down. Naturally, their loan amount of $1.6 million would be jumbo. I received a quote from WSM at 6.25%—a very competitive rate.

Last week, I also attended an open house where the property was listed at $3.885,000. With a 25% down payment, the loan amount would be $2,913,750. At the same 6.25% rate, the monthly payment would be about $17,940. To qualify, the buyer would need an annual income of roughly $600,000.

Fortunately, we have alternative qualification methods that can help clients in situations like this.

Above, I’ve attached The Jumbo Mortgage Flyer for your review. You can also click this link for a printable version.

Meanwhile, feel free to call me anytime at (415) 225-7920 with questions related to the subject matter.

Best wishes,

Manny Kagan,

President,

Pacific Bay Financial Corporation

Your professional mortgage broker since 1983

NMLS #205637

DRE #00874630