A client had a 30 year fixed rate at 4.50% and Mortgage Insurance (MI). Her total monthly payments were $2,270. She called after she had received a flyer in the mail offering 4.25%, fixed for 30 years.

We checked the rates on our computer. 4.25% was available, BUT with closing costs. She wanted a NO-cost loan.

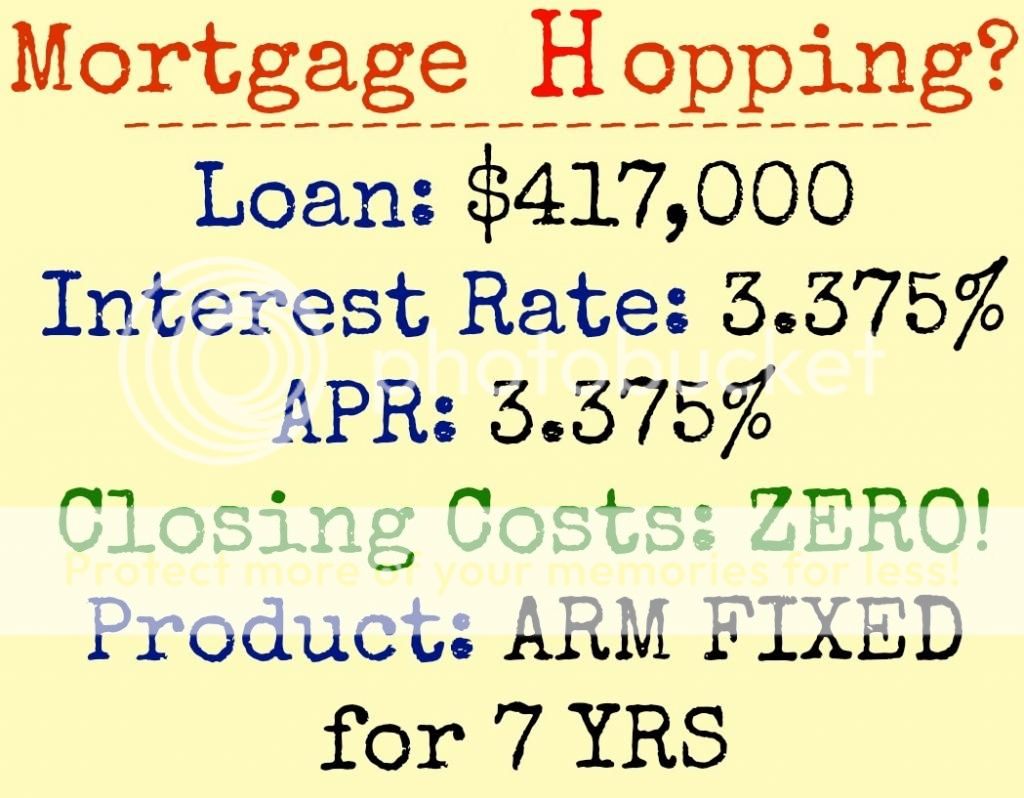

After meeting with her and her husband and finding out about their plans, we offered them a loan fixed for 7 years with the rate of 3.375% (no closing costs).

They agreed to take the loan, but then started shopping around. Someone offered them 3.25%, but when they received the Good Faith Estimate of the closing costs and we analyzed it, we pointed out that it would cost them $1,500 in additional closing costs.

There is always someone who has “better deal”, but how much it will cost at the end is a different story. After our explanations of the mortgage process, the clients decided to stick with us. Meanwhile, two months passed since we first met them.

Their new payment is $1,843 (A total savings of $427–the difference between 3.25% and 3.375% is about $28/month)!

|

Date: Thursday: September 11, 2014 RSVP on Meetup.com OR Facebook OR email Ausra@Pacbay.net |