If knowledge is acquired by asking questions, how do we know which questions to ask?

If knowledge is acquired by asking questions, how do we know which questions to ask?

Category: The Mortgage Game

Tip of the Day

Wisdom of The Day

Mortgage Solutions For You

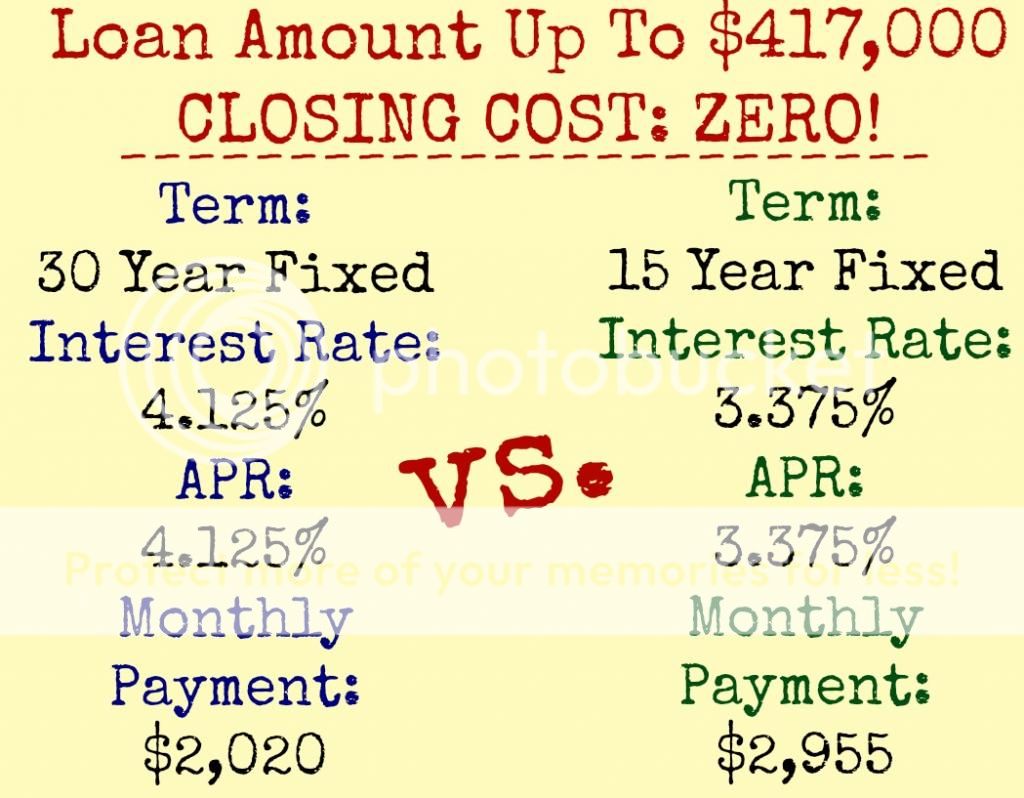

A client in his early 50’s wanted to have his mortgage paid off by his retirement.

We compared two options:

First: A loan fixed for 15 years has a lower interest rate, but higher payments. He was concerned that in the future months, he would not be able to make those payments.

Second: If he would choose a 30 year fixed loan and make his monthly payment $935 more (as if it were a 15 year loan), the balance can be paid off in only 16 years!

He decided to take the 30 year fixed loan and pay the $3,000/month for as long as he can.

|

Date: Thursday: September 11, 2014 RSVP on Meetup.com OR Facebook OR email Ausra@Pacbay.net |

Wisdom of The Day

Tip of The Day

Mortgage Solutions For You!

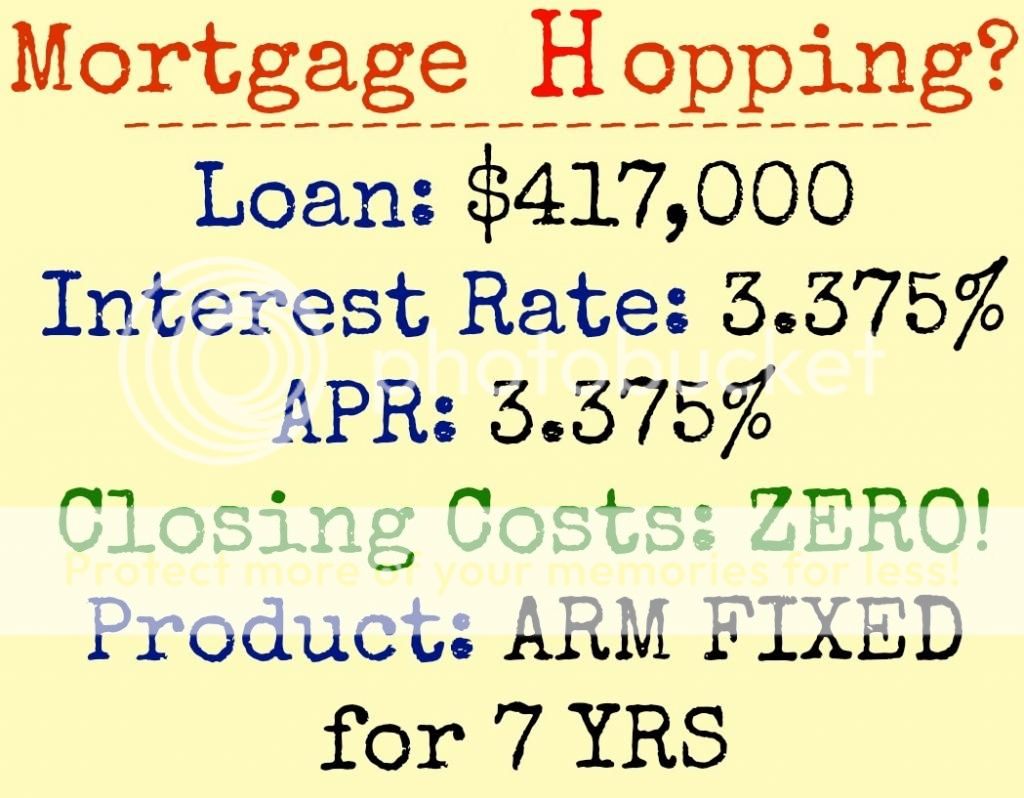

A client had a 30 year fixed rate at 4.50% and Mortgage Insurance (MI). Her total monthly payments were $2,270. She called after she had received a flyer in the mail offering 4.25%, fixed for 30 years.

We checked the rates on our computer. 4.25% was available, BUT with closing costs. She wanted a NO-cost loan.

After meeting with her and her husband and finding out about their plans, we offered them a loan fixed for 7 years with the rate of 3.375% (no closing costs).

They agreed to take the loan, but then started shopping around. Someone offered them 3.25%, but when they received the Good Faith Estimate of the closing costs and we analyzed it, we pointed out that it would cost them $1,500 in additional closing costs.

There is always someone who has “better deal”, but how much it will cost at the end is a different story. After our explanations of the mortgage process, the clients decided to stick with us. Meanwhile, two months passed since we first met them.

Their new payment is $1,843 (A total savings of $427–the difference between 3.25% and 3.375% is about $28/month)!

|

Date: Thursday: September 11, 2014 RSVP on Meetup.com OR Facebook OR email Ausra@Pacbay.net |

Wisdom of The Day

Mortgage Solutions For You!

- They had a foreclosure less than 7 years ago.

- They bought their current home less than 2 years ago and were planning to keep it until October, to avoid paying any taxes.

- Their current home, which has three bedrooms, was financed with an FHA loan.

- General Rule: Borrowers need to pay off their FHA loan BEFORE getting a new one.

- The client started a new job.

- The wife is 6 months pregnant.

- Most of the down payment is a gift from parents.

- They needed to be able to qualify for two mortgages with two mortgage insurances.

- The real estate agent is acting as both buyers’ and sellers’ agent.

- There are two other offers and the real estate agent never worked with our company and recommended her clients use her mortgage lender.

- The credit report did not show the foreclosure, but the lender found out about it from other sources.

- After we found a lender who could do this complex transaction, the clients applied for a loan with another lender who “promised a better deal”.

- They did the same thing to us two years ago.

- When they found out that their lender could not deliver, they came back to us.

- The real estate agent needed to secure an extension for the contract.

- We told the real estate agent that we had never lost a sales transaction over our entire 30-year long career. We knew we would pull this one through as well.

|

Date: Thursday: August 7, 2014 |

Mortgage Solutions For You

A short sale is a sale of real estate in which the proceeds from the selling of the property will fall short of the balance of the debts. When values of the real estate properties dropped for less than the loan amount, many borrowers tried to modify their mortgages while still living in the property. Those who did not succeed and/or wanted to move out could sell their homes and condos by finding buyers who would purchase their property for less after the real estate agents negotiated with the lenders to accept a sales price of equal or less than the loan amount in order to avoid foreclosure. Short Sales were very popular for a while. Now, when property values started to recoup, the picture has changed. At the same time, lenders (or the government controlled secondary markets) are changing guidelines. Buyers who had short sales will have to wait longer (for foreclosures–7 years).

|

Date: Thursday: August 7, 2014 |