MORTGAGE RATES JUST FELL

TO A THREE-YEAR LOW

This headline recently appeared in Money Watch. What’s remarkable is that it happened before the Federal Reserve lowered its benchmark rate by a quarter percent.

As soon as the news broke, a number of my clients called to ask if now is a good time to refinance. For many, the answer is yes—especially if you have a large loan balance.

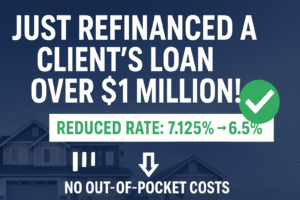

Just last week, I refinanced a client’s loan of over $1 million, reducing their rate from 7.125% to 6.5%, with no out-of-pocket costs. This lowered their monthly payment by about $400. If rates drop again in the next six months, we’ll consider refinancing once more to capture even more savings.

Of course, mortgage rates don’t move only because of the Fed. They’re influenced by broader market forces such as the 10-year Treasury yield, mortgage-backed securities (MBS), and inflation.

While no one can predict with certainty, I believe rates may continue to trend lower—which could improve cash flow for homeowners and help more buyers qualify for financing.

In the meantime, if your mortgage rate is above 7%, give me a call. I may be able to help you bring it down: (415) 225-7920.

Best wishes,

Manny Kagan,

President,

Pacific Bay Financial Corporation

Your professional mortgage broker since 1983

NMLS #205637

DRE #00874630