I received an email from a client, whose loan we refinanced last time in 2011. It was a mortgage fixed for 7 years and the rate would become adjustable in 2018.

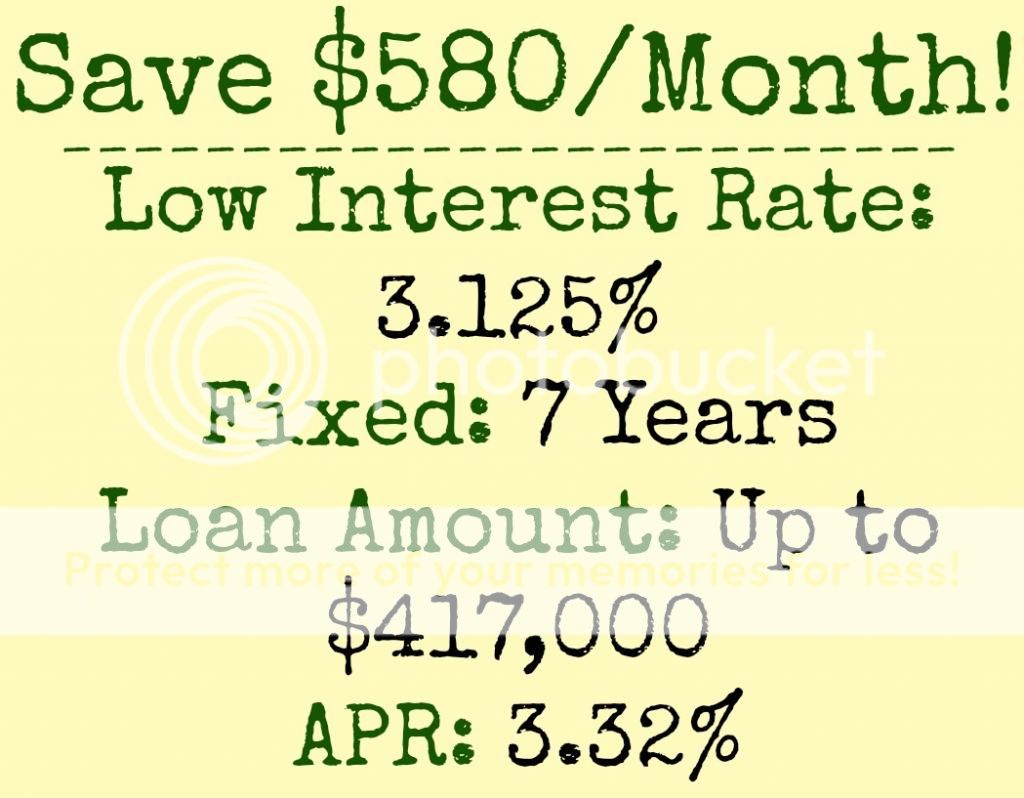

Since then, she accumulated credit card debts, which cost her about $600/month. Being on a fixed income, this situation was challenging. After checking the rates, I saw that we can get her the same rate, extend her fixed loan until 2022, add $30,000 of the credit cards to the mortgage, and her monthly payment would go up only $20/month.

Huge Savings!

Cheers,