A client in his early 50’s wanted to have his mortgage paid off by his retirement.

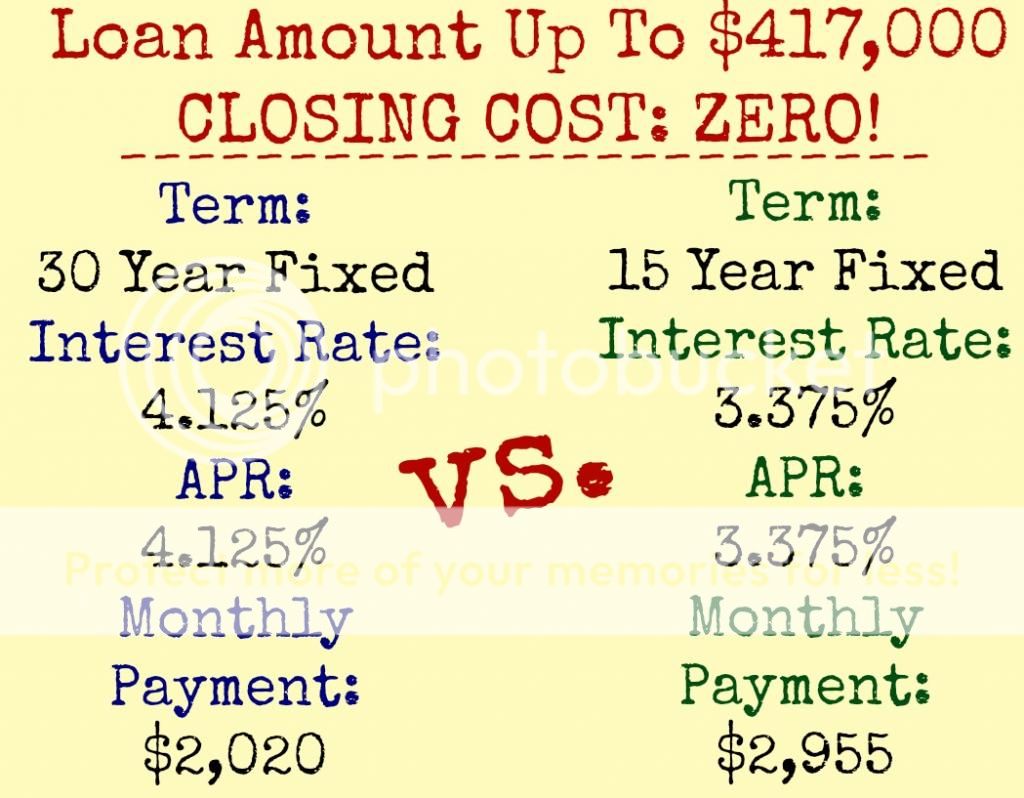

We compared two options:

First: A loan fixed for 15 years has a lower interest rate, but higher payments. He was concerned that in the future months, he would not be able to make those payments.

Second: If he would choose a 30 year fixed loan and make his monthly payment $935 more (as if it were a 15 year loan), the balance can be paid off in only 16 years!

He decided to take the 30 year fixed loan and pay the $3,000/month for as long as he can.

|

Date: Thursday: September 11, 2014 RSVP on Meetup.com OR Facebook OR email Ausra@Pacbay.net |