“We have many reasons to celebrate. Let’s do it.”

I have many reasons for celebrating and find reasons to celebrate every day. As long as I am alive, I can share myself with others. Because two of my close friends who have recently died do not have this privilege anymore, I want to be sure that whatever I have left in this world is shared and celebrated with others.

We all have many gifts to share—as children, parents, relatives, friends, teachers, students, coworkers, and managers. Every day brings new challenges and opportunities, which are all boiled down to our life experiences, many of which we share with others. We laugh, cry, or even curse because of our interactions with others. And I am glad to celebrate my life for this reason.

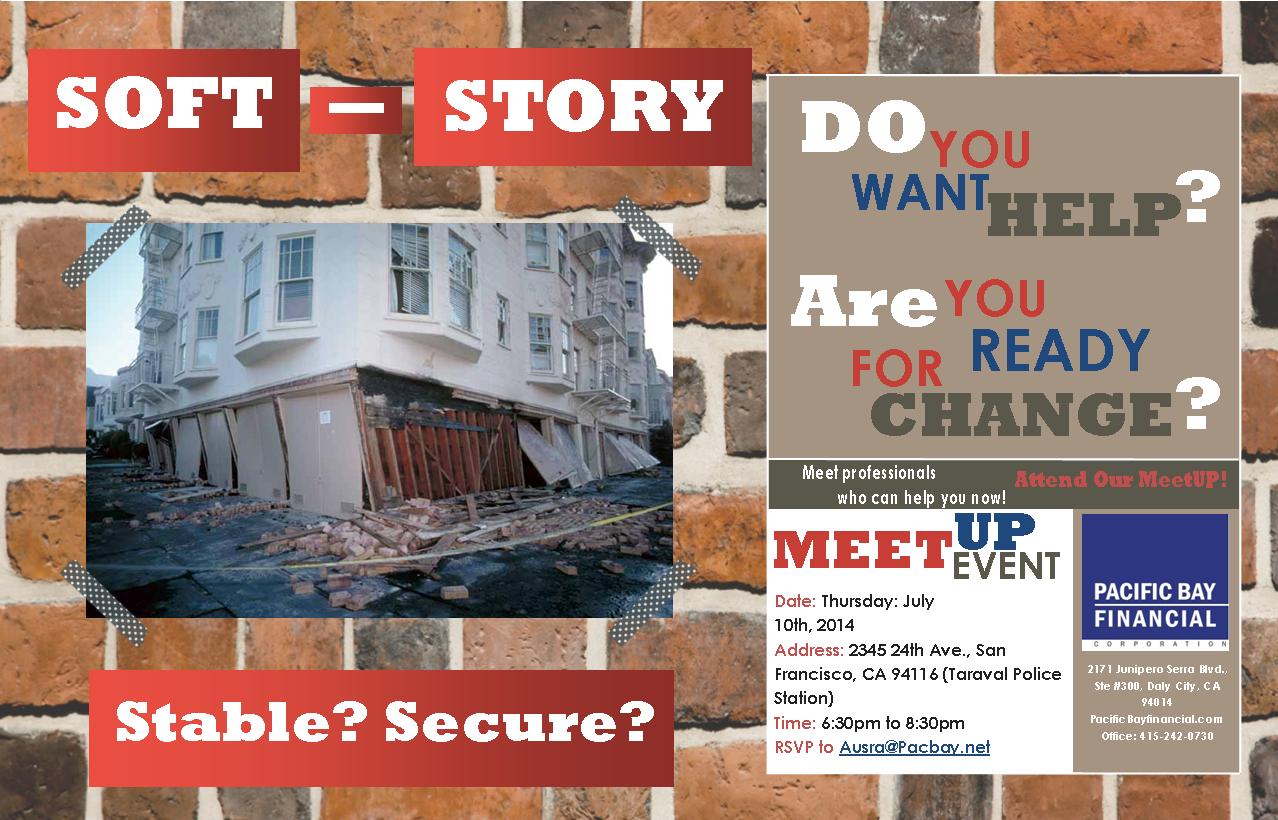

Recently, my friends were blessed with their second grandchild, another friend’s son is getting married, and another just had their 9th child. A very close friend ended the 18th week of chemotherapy with positive results. One of our colleagues, who left our company 5 months ago, returned. At our business, we closed a number of commercial loans. Last month, I helped six clients get a new mortgage and have 6 new ones that will benefit from our services. All of those are great reasons for celebration. And, I have a special reason as well.

My third book “Mortgage Solutions for Smart People: 5 Easy Ways to Get Your Loan Approved” is finally out. It is an e-book and can be ordered through Amazon, Barnes & Noble, Scribed, or from my website. This book is a companion to the first one “The Mortgage Game: The 5 C’s and How To Connect Them”, where I define the 5 C’s, the building blocks of a mortgage as well write about the stories of my clients whom I helped with their mortgages. This book will not only help you get your mortgage the next time you need one, but it will also help you realize what changes you need to make in your life or habits to acquire, in order to be ready to get a mortgage. Getting a mortgage can be a stressful process. We will make it smoother. This requires a celebration. Let’s do it together!

P.S.

We often celebrate major events like New Years and the Independence Day with fireworks. You can see more of my firework photography on my office walls. Please come and visit. And of course—I am very proud to celebrate my three books with you. Soy Cubano, which was created as a book of gratitude, can make a great present. Recently, a friend bought two books as a present for his friends. The photographs and my thoughts shared in Soy Cubano could help you and your friends in your next celebration. To celebrate every day, I am also starting daily tweets, which you can also find on Facebook. Please send me your comments.

Do Not Keep Me As A Secret!

Smile And Please SHARE It With A Friend!