Author of "The Mortgage Game"

“We have many reasons to celebrate. Let’s do it.”

I have many reasons for celebrating and find reasons to celebrate every day. As long as I am alive, I can share myself with others. Because two of my close friends who have recently died do not have this privilege anymore, I want to be sure that whatever I have left in this world is shared and celebrated with others.

We all have many gifts to share—as children, parents, relatives, friends, teachers, students, coworkers, and managers. Every day brings new challenges and opportunities, which are all boiled down to our life experiences, many of which we share with others. We laugh, cry, or even curse because of our interactions with others. And I am glad to celebrate my life for this reason.

Recently, my friends were blessed with their second grandchild, another friend’s son is getting married, and another just had their 9th child. A very close friend ended the 18th week of chemotherapy with positive results. One of our colleagues, who left our company 5 months ago, returned. At our business, we closed a number of commercial loans. Last month, I helped six clients get a new mortgage and have 6 new ones that will benefit from our services. All of those are great reasons for celebration. And, I have a special reason as well.

My third book “Mortgage Solutions for Smart People: 5 Easy Ways to Get Your Loan Approved” is finally out. It is an e-book and can be ordered through Amazon, Barnes & Noble, Scribed, or from my website. This book is a companion to the first one “The Mortgage Game: The 5 C’s and How To Connect Them”, where I define the 5 C’s, the building blocks of a mortgage as well write about the stories of my clients whom I helped with their mortgages. This book will not only help you get your mortgage the next time you need one, but it will also help you realize what changes you need to make in your life or habits to acquire, in order to be ready to get a mortgage. Getting a mortgage can be a stressful process. We will make it smoother. This requires a celebration. Let’s do it together!

P.S.

We often celebrate major events like New Years and the Independence Day with fireworks. You can see more of my firework photography on my office walls. Please come and visit. And of course—I am very proud to celebrate my three books with you. Soy Cubano, which was created as a book of gratitude, can make a great present. Recently, a friend bought two books as a present for his friends. The photographs and my thoughts shared in Soy Cubano could help you and your friends in your next celebration. To celebrate every day, I am also starting daily tweets, which you can also find on Facebook. Please send me your comments.

Do Not Keep Me As A Secret!

Smile And Please SHARE It With A Friend!

|

Date: Thursday: August 7, 2014 |

“A good movie can stimulate your appetite, but you need good food to enjoy life.”

Seventeen years ago, Ed Crane, a fellow mortgage broker, and I spearheaded the first chapter of BNI (Business Network International) in San Francisco. Today, there are71 chapters all over the Bay Area. As the name implies, BNI is a networking organization. Once a week, groups of professionals from various industries gather together for breakfast or lunch and exchange referrals, create friendships, and long lasting relationships. And of course—generate substantial (for some) steady income from the referrals. At every meeting, we go around the room, re-introducing ourselves and our occupation, for the benefit of our guests (some of whom become new members).

Our chapter has close to 30 members and we meet for lunch every Wednesday, in Downtown, San Francisco. To keep introductions more interesting and to share some of our personal trivia, we have a theme each week. Last week, we had to share what recent movie we’ve seen. Many mentioned “Chef”. When my turn came, I told the group that in our family, my wife Elfa is in charge of our entertainment. She checks relevant news, the Pink Pages, and usually on Sunday afternoons, we have our outing to the movies. For me, it is just a relaxing time to spend together with my wife.

P.S.

In San Francisco, we have many movie theaters. Some of them not only serve you popcorn, but also have a full bar and comfortable chairs in the lobby to enjoy ice cream before or after the movie. And if you want to experience good food, there are so many restaurants here as well, where chefs create their amazing feasts with love. Some of my images are from ISA on Steiner, Out The Door on Bush, (the little sister of The Slanted Door on Embarcadero), my recent discovery–the 20th Century Café on Gough and Oak, and of course our favorite—Zuni Café on Market.

Do Not Keep Me As A Secret!

Smile And Please SHARE It With A Friend!

|

Date: Thursday: July 10th, 2014 |

“If you continue to keep your head in the sand, you will get a kick on your behind.”

In the book, “Peace of Mind in Earthquake Country: How to Save Your Home, Business, and Life” by Peter I. Yanev and Andrew C.T. Thompson, they found that “there is a 62 percent probability that at least one earthquake of magnitude 6.7 or greater will occur on a known or unknown San Francisco region fault before 2032” (44).

They also wrote that “the estimated consequences of a major earthquake in this case (a repeat of the 1906 M7.9 quake) striking the bay area will result in 3,400 instantaneous deaths and direct economic losses (including business interruption) of $120 billion” (44).

Are you prepared?

There are many buildings in the Bay Area and particularly in San Francisco, which have an opening for the garages, or stores. This design is called a “soft story” and weakens the structure of the building. To prevent damage, the city of San Francisco created the Soft Story Retrofit Program, which resulted in the creation of ordinance NO66-13. The ordinance applies to wood frame buildings of three or more stories or two stories over a basement containing five or more residential dwelling units where a permit for construction was applied prior to January 1, 1978. In September 2013, the Department of Building Inspection sent notices to about 6,000 property owners.

Did you receive one?

Do you know what to do?

Do you know who can do the work and the steps involved?

Do you know where to find financing?

Do you know that your bank may not renew your mortgage and your insurance company may not insure you if you will not fix your building?

Three years ago, we started an educational campaign conducting seminars, in attempt to get building owners’ attention. Most just stuck their heads in the sand. But now there is no choice. Luckily this time, the cost can be passed through the tenants—but how?

We want to help protect your investment.

Our next MeetUP Event will bring professionals who will shed some light on the huge problem. Even if your building, home, or rental property is not on the list, the earthquakes will not discriminate. Do not wait.

P.S.

In Havana, I photographed a number of buildings, which would not have a chance to survive a 7.2 magnitude earthquake, like the one that recently hit Acapulco, Mexico and was centered on a long dormant fault line.

DO NOT KEEP ME AS A SECRET.

SMILE AND PLEASE SHARE IT WITH A FRIEND

A Client sold his home for $2,000,000. The balance on his mortgage was $1,000,000. After paying real estate commission, transfer tax, and giving $88,000 to Uncle Sam, the net was $800,000. He found a home in Sonoma and paid cash to avoid competition. He wanted to refinance after the close of escrow.

At that moment, he discovered:

Home Acquisition Debt

Home acquisition debt is a mortgage you took out after October 13, 1987, to buy, build, or substantially improve a qualified home (your main or second home). It also must be secured by that home.

If the amount of your mortgage is more than the cost of the home plus the cost of any substantial improvements, only the debt that is not more than the cost of the home plus improvements qualifies as home acquisition debt. The additional debt may qualify as home equity debt (discussed later).

Home acquisition debt limit.

The total amount you can treat as home acquisition debt at any time on your main home and second home cannot be more than $1 million ($500,000 if married filing separately). This limit is reduced (but not below zero) by the amount of your grandfathered debt (discussed later). Debt over this limit may qualify as home equity debt (also discussed later).

Mortgage treated as used to buy, build, or improve home.

A mortgage secured by a qualified home may be treated as home acquisition debt, even if you do not actually use the proceeds to buy, build, or substantially improve the home. This applies in the following situations.

Home Equity Debt

If you took out a loan for reasons other than to buy, build, or substantially improve your home, it may qualify as home equity debt. In addition, debt you incurred to buy, build, or substantially improve your home, to the extent it is more than the home acquisition debt limit (discussed earlier), may qualify as home equity debt.

Home equity debt is a mortgage you took out after October 13, 1987, that:

Example.

You bought your home for cash 10 years ago. You did not have a mortgage on your home until last year, when you took out a $50,000 loan, secured by your home, to pay for your daughter’s college tuition and your father’s medical bills. This loan is home equity debt.

Home equity debt limit.

There is a limit on the amount of debt that can be treated as home equity debt. The total home equity debt on your main home and second home is limited to the smaller of:

Whom do you know that might benefit from our tailored mortgage solutions?

SMILE AND PLEASE SHARE IT WITH A FRIEND

On the dawn of June 28th, Muslims, 23% of the world’s population, will celebrate Ramadan. For one month during the day, they will refrain from eating, drinking, smoking, and copulating until after sunset. The story about Ramadan is the last one in my series that unites us, despite the division manifested by different religions.

Much of the Western knowledge of the Muslim religion may be based on the limited and negative press about militant Islamist groups, who are known to behave violently toward one another and the rest of the world. The observance of Ramadan is considered one of the five pillars of Islam, as commanded in the Holy Quran by Muhammad, who was born in about 570 CE in the Arabian city of Mecca. Muhammad received his first revelation from God at the age of 40 on the month of Ramadan. Three years later, he began to preach and publicly proclaim that God is One. The Islamic religion then spread very quickly in the Arabian world.

There are about 1.4 billion Muslims who live all over the world. I recently learned that there are more Muslims (344 million) in India and Pakistan combined, than in the entire Middle East (317 million).

I do not think any of us can comprehend what influences other people’s beliefs and actions, but at least I’ve tried. For intellectual curiosity, I have read the Quran, albeit in English, as well as some books about Islam. (I have read about other religions as well.) My conclusion: unless you are Muslim, or adhere to any other religion, you cannot truly understand why people do what they do.

But then I found something in common with other traditions. After Ramadan ends, there is a huge feast for three days. Muslims in each country have their own traditional meals. But no one has yet said no to a good cheesecake, especially one produced by the company Sara Lee with the stamp of approval for Halal (similar dietary restrictions to Kosher rules for the Jewish religion). For instance, those cakes do not contain pork or alcohol. Thank God—I would not eat those either.

P.S.

We usually recognize representatives of various religious groups by their specific attire. Women who practice Islam wear a head scarf (Hijab), which covers their hair. In the Jerusalem market, I photographed a display of brightly colored hijabs. In some countries, women also cover their regular clothing when in public with a long cloak called Abaya. My images that you see here were taken in Jerusalem and San Francisco. Despite the difference in practice, we all belong to the same group—humans. Let’s behave and treat each other as such. Let’s share cheesecake together!

It is still not too late to get a FREE one! Just share your excitement about our services with your friends and contact me.

If you want to have your cake and eat it, just give this card to get it.

(click flyer for details)*

*Limit one cheesecake per family for successful referrals

DO NOT KEEP ME AS A SECRET.

SMILE AND PLEASE SHARE IT WITH A FRIEND

After a client sold her rental building in San Francisco, she needed to buy another property to avoid paying taxes, while using 1031 Tax Deferred Exchange. When we met, I explained to her that after we will find a lender with the best option, we would have to charge an extra 1% from the loan amount for our services in addition to the bank fees. She hesitated and later on informed me that she is keeping her money at CHASE bank and can apply with them directly since this can save her $30,000.

Fortunately for her and for us, her real estate agent with whom we have a working relationship, convinced her to give us a chance.

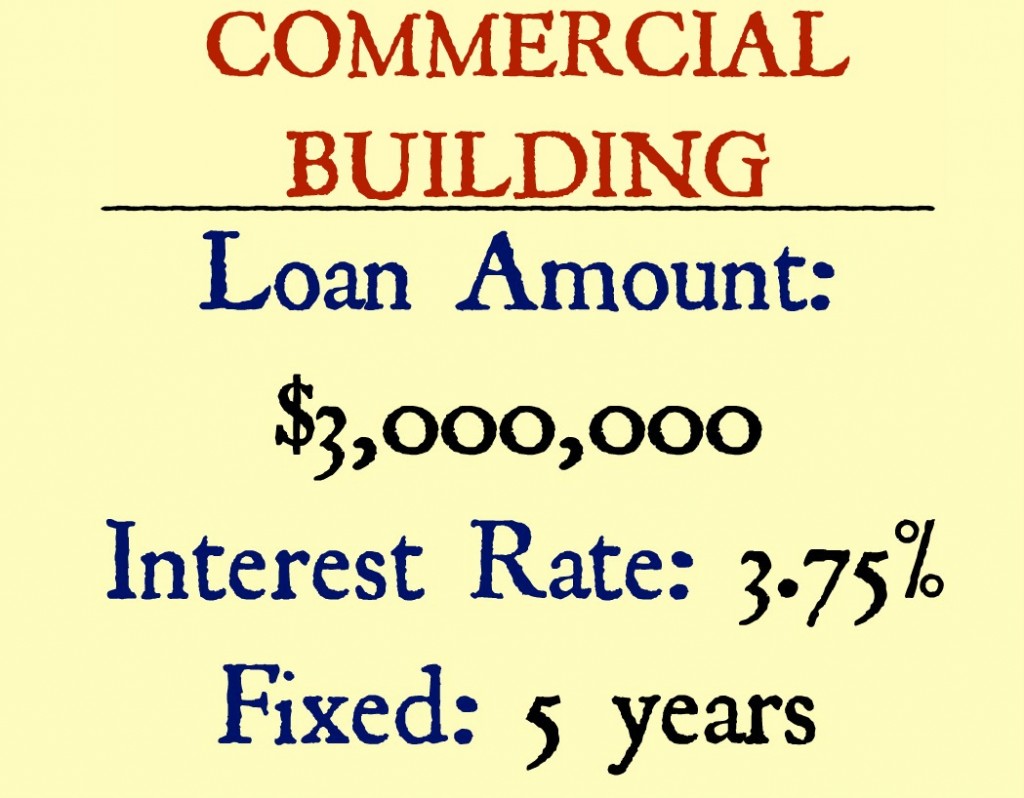

We submitted her loan request to 5 different banks–including CHASE. After all of them gave us different quotes, we narrowed it down to CHASE and Wells Fargo. After negotiating back and forth, where each bank wanted to receive the business, Wells Fargo agreed to lower their interest rate to 3.75% and CHASE (as well as other banks) informed us that they cannot lend on the subject property.

If the client would have applied for the loan with her bank, she would have lost the transaction and have to pay taxes.

Whom do you know that might benefit from our tailored mortgage solutions?

Don’t forget to participate in this month’s Cheesecake Special.

SMILE AND PLEASE SHARE IT WITH A FRIEND