*Interest rates are subject to change without notice and do not constitute a commitment to make any loan at any specific rate.

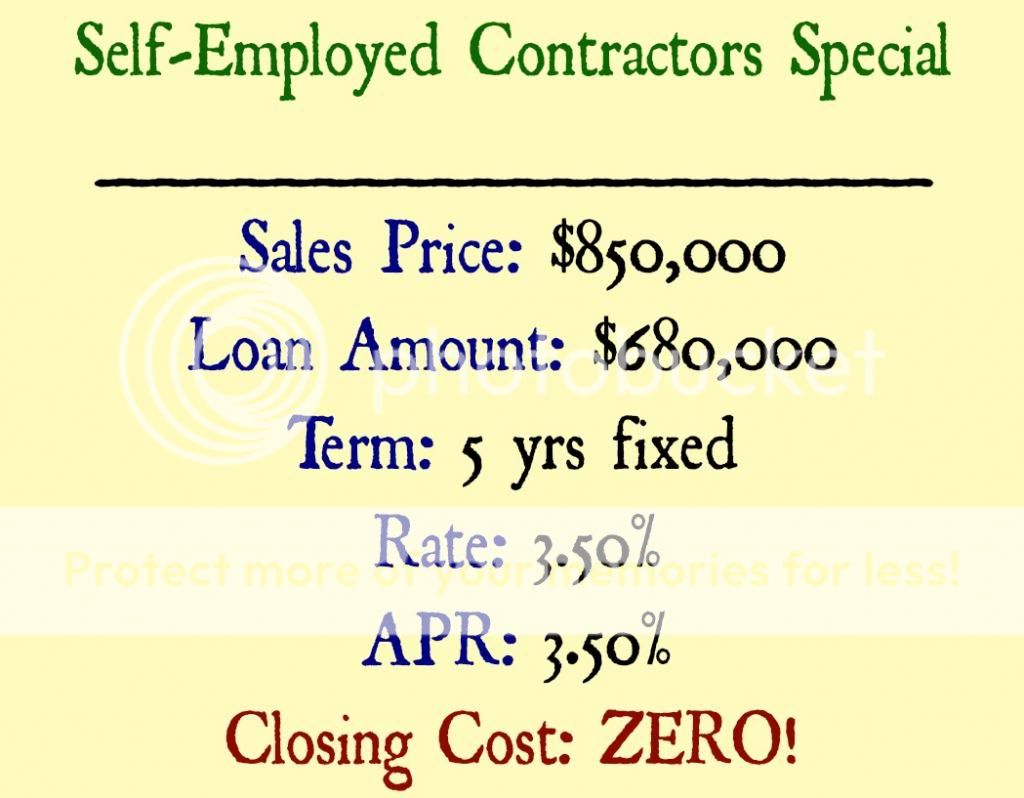

A client worked for one of the major companies in the Bay Area. For the past three years, he had a salary and received a W2 at the end of the year. He was offered to change his status to a contractor, which would increase his income, but also converting him into a self-employed 1099 person. Most lenders require two years proof of such an income.

We found a solution!

One of our lenders offers great rates for those who are self-employed for less than two years–as long as there is at least one year to support their current income.

This same lender also accepts 100% gifts for the down payment.

What are you waiting for?

Whom do you know that might benefit from our tailored mortgage solutions?

Do not keep me as a secret.

SMILE AND PLEASE SHARE IT WITH A FRIEND