HAPPY NEW YEAR!

It’s difficult to believe, but 2026 is already here.

Are you ready? We have to be ready—even though readiness often begins before the date itself. In truth, preparation for 2026 started in 2025. A year is just a number on the calendar, but life doesn’t move by dates alone.

For me, 2025 was a meaningful year. Business-wise, it was a good year. We survived, we endured, and that alone carries gratitude. More than that, it gave me confidence and hope. I am genuinely looking forward to 2026, believing it will be a great year.

One of the highlights of 2025 was producing my book, Reflections: The Healing Images. I use it daily for meditation, and I truly believe it can serve as a gentle healing companion for anyone who opens it with intention. I encourage those who feel drawn to it to experience it for themselves. You can order it on Amazon.

But something else happened this past year—something unexpected.

This past Sunday, while walking our Labradoodle, Max, in our quiet and hilly neighborhood, I decided to follow a recommendation I had heard: to try walking backward. Supposedly, it stimulates the brain and improves awareness. At first, it felt easy. The ground was flat—no problem. Then the path started going uphill. Still manageable.

But then came the downhill.

Without realizing it, my legs began moving faster and faster. A thought crossed my mind: I could fall. I decided to stop—but stopping while moving downhill is not so easy. I turned around, lost my balance, and fell hard onto the pavement. My head hung over the road. Thankfully, nothing serious happened. I bruised my hip and injured my shoulder. The hip healed quickly, but the shoulder still aches and affects my sleep. I know—it takes time.

Max, sensing something was wrong, jumped around me anxiously. His presence—his concern—gave me the strength to get up.

Later, reflecting on the experience I had some reflections.

Here is what that moment taught me:

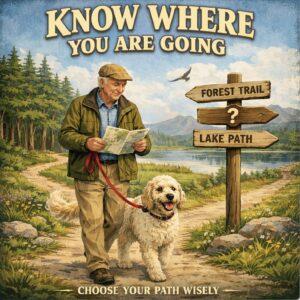

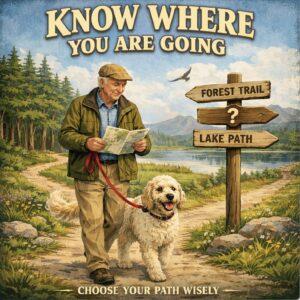

- Know where you are going.

- Look forward, not backward, especially when moving ahead.

- When life goes downhill, it can accelerate very quickly.

- If you believe you might fall, sometimes stopping requires falling first.

- Have a good friend—who helps you rise.

- If you choose a different direction, prepare properly.

I still believe walking backward has value—but next time, it will be on a flat surface, or in a gym where the environment is controlled. Wisdom doesn’t reject new ideas; it adjusts how we practice them.

The deeper point is this: whatever direction you choose in life, prepare yourself. Choose wisely. Be aware of the terrain.

As we step into 2026, I wish you a year that is Happy, Prosperous, Healthy, and Joyful. Let’s do it together. Let’s make this year meaningful.

Three images of flowers decorating this story are from my shortly coming book “How to Enjoy Comfortable Aging. 42 Manifestations.”

If you happen to be in the San Francisco Bay Area on Thursday, January 8, you are welcome to join me for the open conversation about aging. The event will take place at 6:00 pm at Eria Events, 562 Bridgeway, Sausalito, CA 94965. Admission is free.

We will discuss:

- Aging & Longevity

- Divorce & Mortality

- Exercise & Meditation

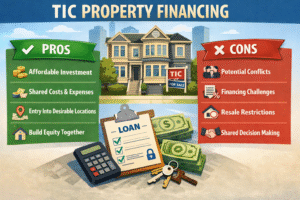

- Mortgages & Rightsizing … and much more

Thank you.